Deep-Dive #3: Solid-State Batteries — An Energy-Dense Frontier

New Architectures Separating Themselves From the [Battery] Pack

Batteries are a critical component of our lives:

Americans purchase nearly 3 billion dry-cell batteries every year to power radios, toys, cellular phones, watches, laptop computers, and portable power tools

Nearly 99 million lead-acid car batteries are manufactured each year in the U.S.

Just between 2015 and 2020, the number of battery factories under construction or in planning increased from 4 to 181 (136 are in China alone) — and this number will continue to grow exponentially

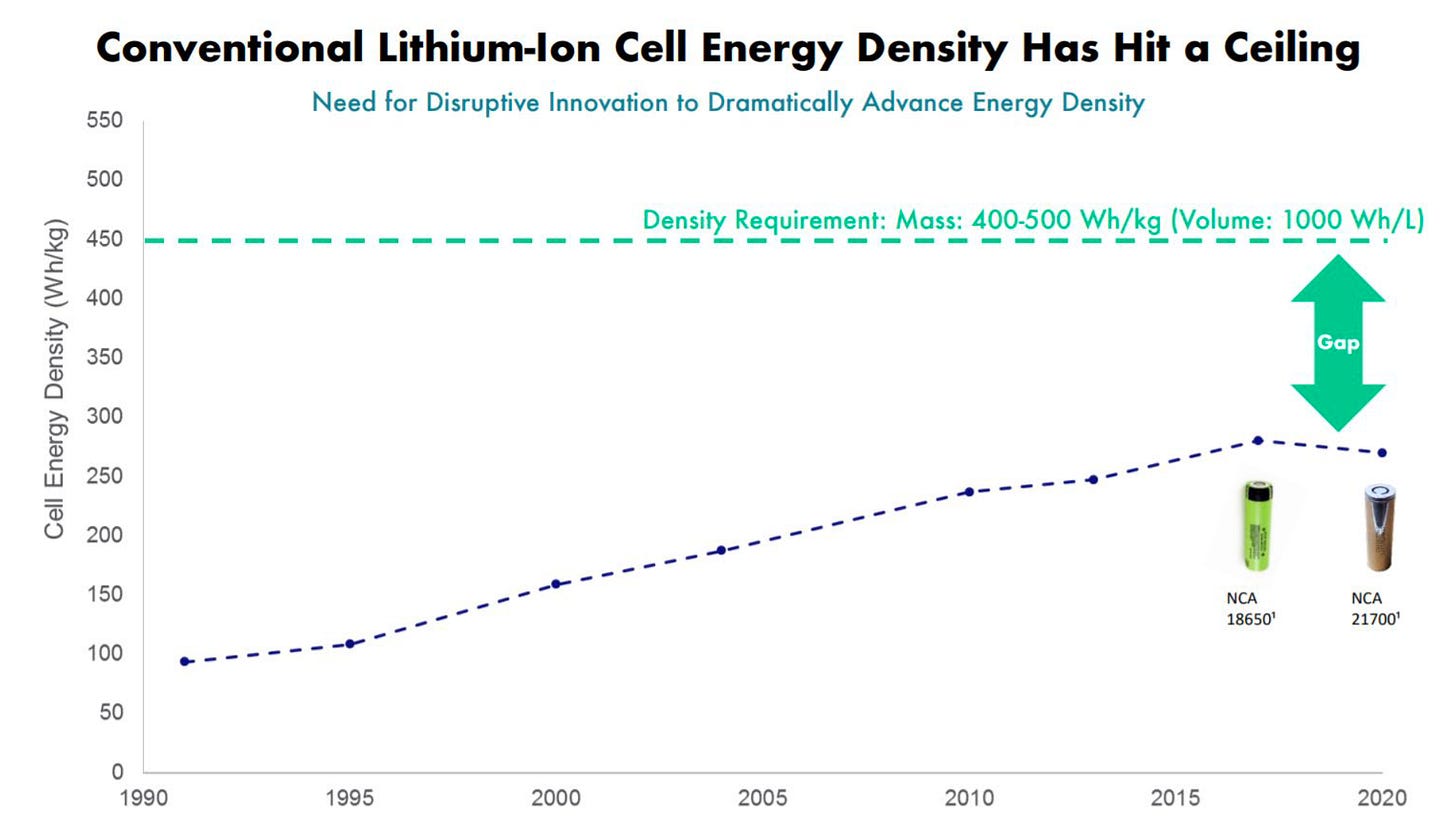

Despite skyrocketing global demand for batteries (notably in the face of higher commodity prices and supply chain constraints), battery technology has not seen a paradigm shift since lithium-ion batteries saw consumer acceptance in the mid-1990s. Although improved battery designs and incremental semiconductor enhancements have allowed for cheaper lithium-ion battery price points, electric vehicles (“EVs”) still face mileage limits due to heavy battery weight relative to charge capacity — and these large, high-powered batteries still currently comprise 30-40% of total EV costs.

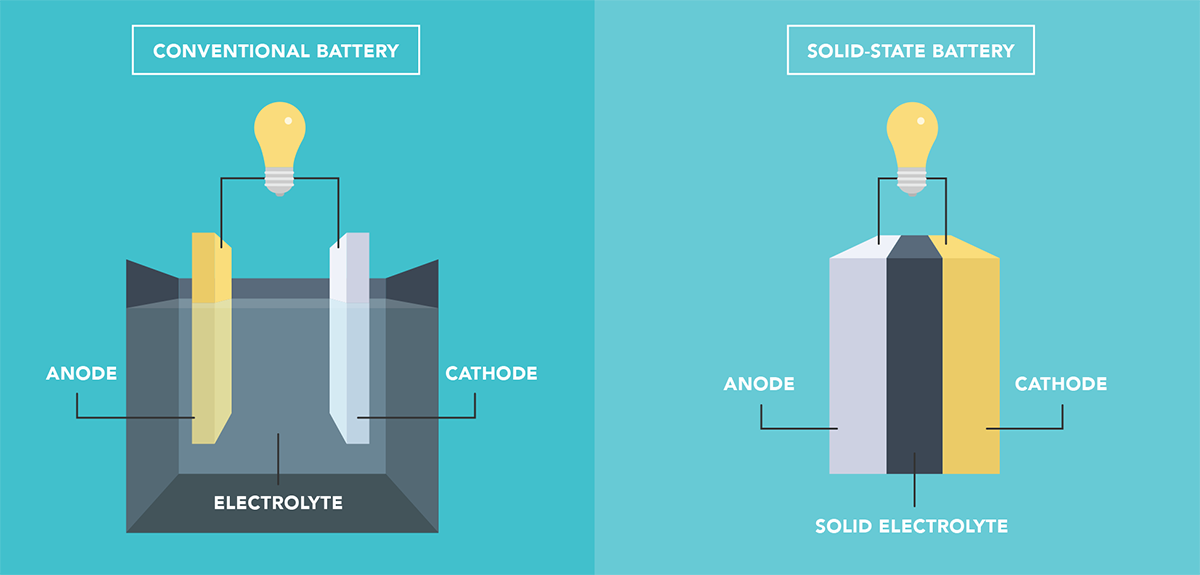

Potentially solving for these issues are solid-state batteries, which represent the next frontier in battery architecture. Unlike lithium-ion batteries, solid-state batteries do not contain heavy liquid electrolytes. Replacing the liquid with solid, lighter materials like ceramics, polymers, or light metals, solid-state batteries in theory can be much denser and compact, translating to more capacity and less fire risk.

Solid-state batteries have the potential to surpass the highest theoretical performance of the lithium-ion architecture, delivering unparalleled energy density that will be needed to enable truly long-range EVs, as well as other applications like air drones and microelectronics.

This post will discuss the development history of solid-state batteries, the major players in the space and their technical approaches, and as always, my personal predictions and outlook for this technology paradigm.

Industry History: From Electrons to Modern Electrochemical Cells

Electrifying Discoveries

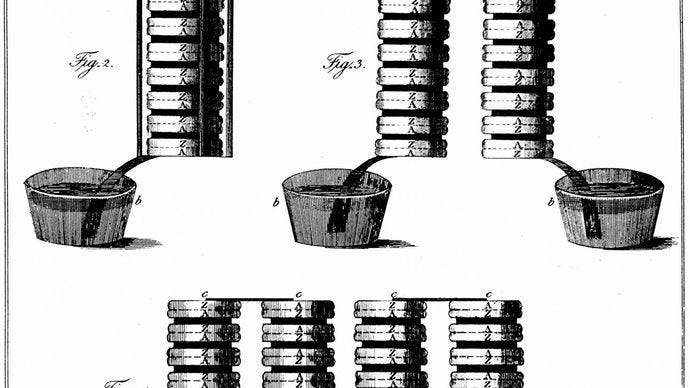

The now ubiquitous invention of the battery traces all the way back to the year 1800, when Alessandro Volta (for whom the “volt” or “voltage” unit of electrical potential difference was named), created a system that he called the “wet pile.” This device consisted of alternating zinc and silver disks separated by layers of paper or cloth soaked in a solution of either sodium hydroxide or brine.

For the first time, a device could generate electricity chemically and be made to flow evenly through a conductor in a closed circuit, which was mind-blowing because previously it was assumed that all electricity was produced by living beings, in what was called “animal electricity.”

A pair of French engineers led the way on developing the next advances in battery systems.

In 1859, Gaston Planté invented a lead-acid cell, the first practical storage battery (and later formed the basis of the modern lead-acid automobile battery).

Then shortly thereafter in 1866, another Frenchman, Georges Leclanché, built a zinc–manganese dioxide battery system that used a true liquid electrolyte for the first time. Leclanché’s cell had an electrolyte (i.e., a medium that can transfer ions and enable the flow of electrical current) consisting of a liquid solution of ammonium chloride.

A form of the cell was later used for conversations on the first iterations of the telephone (invented in 1876), placed into an adjacent wooden box affixed to the wall — before telephones could draw power from the telephone line itself. The Leclanché cell could not provide a sustained current for very long, so in lengthy conversations, the battery would run down, rendering the conversation inaudible. Although rudimentary, the liquid electrolyte idea was used broadly in future battery concepts, including the modern lithium-ion battery.

In parallel with these discoveries was ion conduction (i.e., the transfer of electrically charged atoms) in solids, which was discovered by Michael Faraday in 1833. Faraday experimentally demonstrated that the electrical conductivity of Ag₂S crystals (silver sulfide — now used as a photosensitizer in photography) was primarily increased with a rise in temperature. Many historians also call this the first experimentally recorded “semiconductor effect,” and solid conductivity is now recognized as a foundational property of semiconductor materials.

The Solid Electrolyte

Despite advances in electrical applications and power generation over the second half of the 19th century and first half of the 20th century, solid conductivity and modern battery technology did not fully come together until the 1960s.

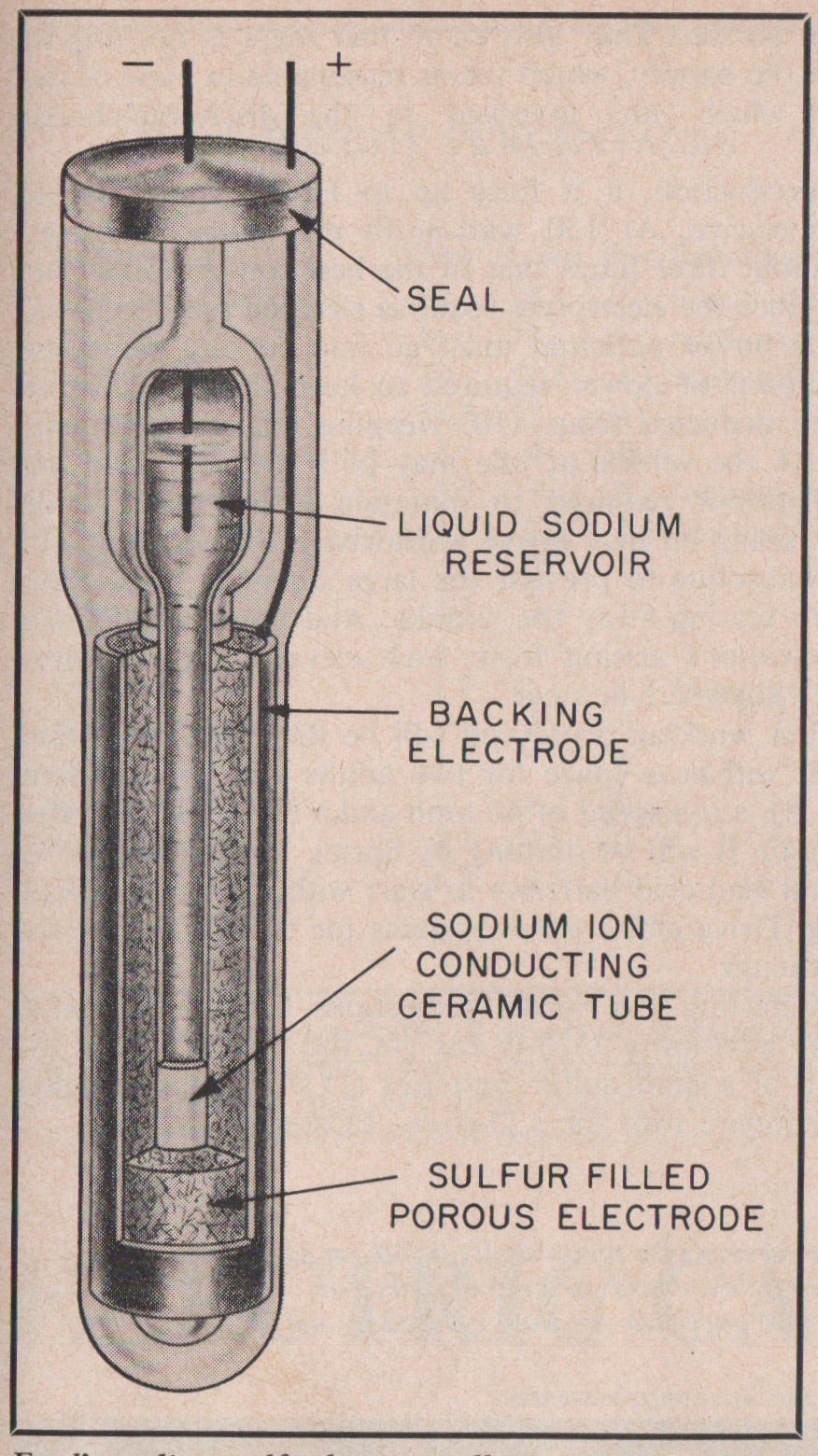

Beta-alumina, a solid metal sodium-ion conductor, was discovered to be an excellent solid electrolyte by the Ford Motor Company in the late 1960s, and development of a useful electric automotive battery frantically accelerated as the 1970s oil crisis unfolded.

Ford was able to develop a commercially relevant high-temperature sodium-sulfur battery, which then formed the inspiration for the sodium-nickel-chloride ZEBRA battery (developed by the Zeolite Battery Research Africa Project in Pretoria, South Africa in the 1980s).

While promising greater energy densities, these batteries required a very high operating temperature (over 570 degrees Fahrenheit) and utilized materials that corroded easily. Additionally, these two batteries were not exactly solid-state because the electrode materials were molten — but these batteries were a critical step toward commercial interest in solid electrolyte usage.

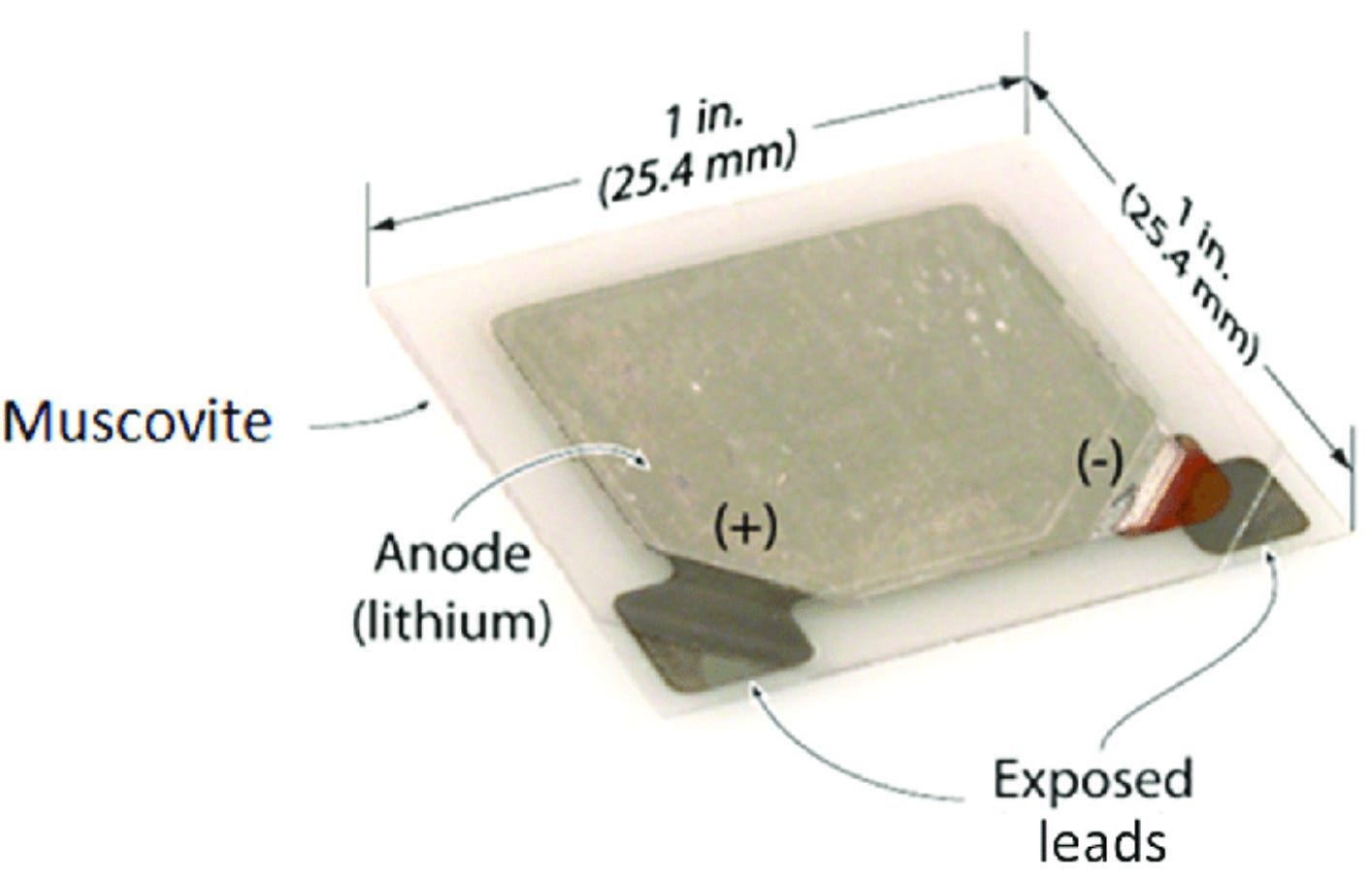

The subsequent discovery in 1983 of lithium phosphorus oxynitride (LiPON) at Oak Ridge National Laboratory resulted in the development of thin-film solid-state batteries that could function at ambient temperatures (i.e., does not need to be heated to extremely high temperatures to function) and had strong cycling stabilities (i.e., ability to effectively charge and discharge a battery) — which had never been done before.

Thin-film batteries faced challenges of their own, primarily the fact that the hair-thin current collector had brittle electrode coatings, making the battery easily susceptible to wear-and-tear at high-output, complex conditions (e.g., those needed for electric vehicles).

Given lightweight, high-performance at smaller scales, thin-film solid-state batteries are actually popularly used today in various microelectronics, including certain wireless sensors, implantable medical devices, pacemakers, and Radio Frequency Identification (RFID) tags (e.g., the bulky plastic security tag affixed to clothes in retail stores).

Modern Solid-State Batteries

The most ambitious jump in solid-state battery performance since the 1990s has been the leap from thin-film solid-state batteries to all solid-state batteries (ASSBs) with high energy densities and scaled power output.

Most current solid-state batteries utilize a thick solid electrolyte with materials ranging from metals to ceramics to polymers, with different variations on the anode and cathode depending on the type of electrolyte used and the end application.

The breakdown below will delve into each major type of modern ASSB, breaking down the latest technological advances.

Technology Breakdown: Separate Paths via Solid-State Separator Types

Conventional Battery Science

Before diving into the solid-state battery paradigm, it’s critical to understand how the current lithium-ion battery architecture functions for comparative purposes.

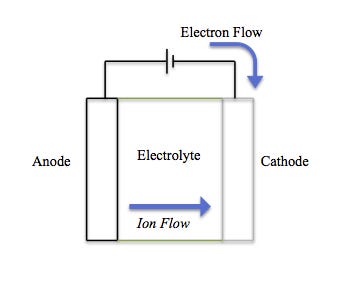

Broadly speaking, a battery is a source of electrical power that utilizes chemical reactions in order to power external devices. These chemical reactions, called redox reactions, catalyze the flow of electrons from one material (electrode) to another, through an external circuit.

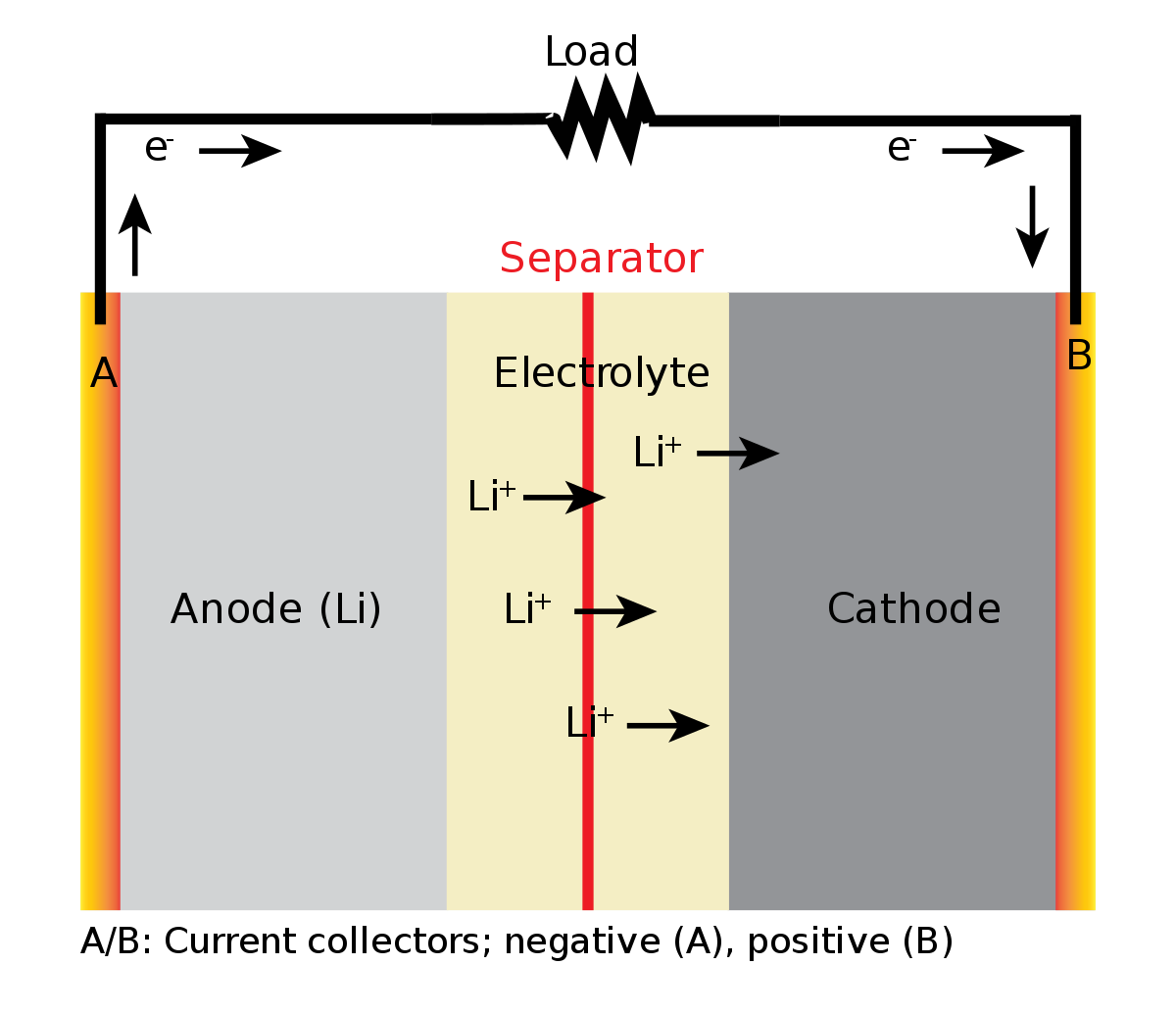

An electrolyte is the substance in a battery that separates the anode (negative electrode) from the cathode (positive electrode). Electrons from the anode move through an external circuit while lithium ions travel through the electrolyte and into the lithium ion vacancies in the cathode created by the prior charge step. The flow of electrons provides an electric current that can be used to power a connected device.

Simple enough, right? Negatively charged electrons transfer in one direction and are offset by positively charged ions transferred in the other direction — this flow creates electricity.

However, the possibilities are endless in terms of the different combinations of materials used for the anode, cathode, and electrolyte — with many being optimal for different performance conditions and end applications.

Current Lithium-Ion Batteries

Of these aforementioned combinations, the lithium-ion concept became popular because the metal lithium (Li), a simple element with only 3 protons, is the lowest-weight of all metals in existence and thus has one of the best energy-to-weight ratios, as well as several ideal electrical properties such as high open-circuit voltage, low self-discharge rate, and a slow loss of charge when not in use.

In a lithium-ion battery, the anode is partially or completely made of lithium, and during battery operation, the lithium metal breaks off into free ions that move toward the cathode. The movement of the lithium ions creates free electrons in the anode which creates a charge at the positive current collector. The electrical current then flows from the current collector through a device being powered (cell phone, computer, etc.) to the negative current collector.

Lithium-ion batteries were revolutionary when invented in the 1990s because (i) lithium is a widely available metal on Earth and relatively cheap compared to rare-earth metals, (ii) lithium-ion batteries can be highly energy dense, (iii) they can be configured for rechargeability with low degradation over time, and (iv) scalability (e.g., a small version can be used in a video game controller, and a large version can be used to store massive amounts of energy generated by an array of solar panels).

Given its widespread usage today across dozens of major applications, the lithium-ion architecture will likely be relevant over the next 100+ years, which is important to keep in mind — solid-state batteries will not be a “be-all and end-all” that permanently replaces lithium-ion batteries, but they have the potential to be superior in certain key use cases.

Solid-State Battery Foundations

Solid-state batteries, in the simplest definition, represent a battery that has an all-solid electrolyte / separator facilitating ion transfer between the anode and cathode.

The key principles of solid-state batteries are discussed below.

Key Metrics

Energy density, the measure of how much energy a battery contains in proportion to its weight (units are Watt-hour per kilogram, abbreviated Wh/kg), is arguably the most important metric when benchmarking battery performance. Especially given that the battery is the heaviest part of an electric vehicle, high energy capacity relative to weight is critical for achieving higher mileage range and increased performance.

Measuring output relative to cost is also critical for EV adoption. Current lithium-ion batteries for EVs have ~$130 / kWh price points at lowest. Solid-state batteries, by excluding expensive materials and forgoing the liquid electrolyte, have the potential to reduce cell costs below $100 / kWh, a commonly cited tipping point for the mass adoption of electric vehicles.

ASSB Benefits

All-solid-state batteries (ASSBs), at their fullest potential, can provide the following advantages:

Battery capacity and longevity — longer mileage range and ability to maintain performance over lifetime usage following repeated charges (600+ mile range on single charge versus current industry avg. of ~180 miles; 500K+ mile lifetime range versus current industry avg. of ~200K miles)

Charge time — quick charge times for minimal interruptions in long-distance travel (15 minutes or less to complete a full charge for ASSBs vs. nearly an hour or longer for lithium-ion)

Safety — removal of the flammable liquid electrolyte found in lithium-ion batteries virtually eliminates the risk of fires

Cost — decreasing overall cost of battery by removing usage of expensive materials like nickel and cobalt (e.g., anywhere from $70-90 / kWh in the long-term for ASSBs vs. expected ~$100 long-term ceiling for lithium-ion)

Drivers of ASSB Performance

When evaluating ASSBs, the chosen battery structure and materials result in varying tradeoffs amongst the following metrics:

Chemical reactivity — non-reactive battery materials are ideal given that even slight chemical reactivity can adversely impact and change the battery over time

Conductivity — higher conductivity allows for more ions to pass through the battery at a given time, improving capacity at higher discharge rates

Volume — compact size to minimize space taken up within an electric vehicle

Dendrite prevention — metal build-up that often occurs at the anode in ASSBs (discussed further below)

Operating temperature — some ASSBs necessitate high operating temperatures, which involve significant input energy and decrease battery efficiency. The battery structure and materials ideally need to be selected such that the battery can operate at normal ambient temperatures

Dendrite Formation

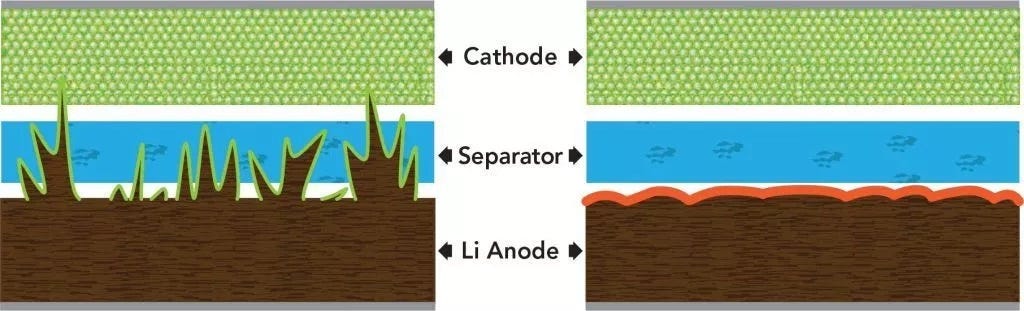

Dendrites are metal spikes that form on the anode as ions flow inside the battery cell. The contact of solid separator on the anode plate can cause chemical reactions that cause metal formation in concentrated areas on the anode surface. These buildups eventually take the form of large spikes, which can penetrate completely through the solid electrolyte into the cathode and effectively short-circuit the battery (i.e., current can no longer flow).

Performance Limitations

The two largest limiting factors for ASSBs at the moment are:

Developing scalable manufacturing processes and lowering costs (8-10x the cost of lithium-ion currently)

Solving for adverse electrodeposition / deformation (metal build-up) at the battery cell anode, which causes dendrite formation that can short-circuit the battery

With these challenges in mind, major players in the solid-state battery space are targeting anywhere from 2026-2029 for scaled production of solid-state batteries at commercially viable price point.

Key Categories and Industry Players

The discussion on types of solid-state batteries will primarily be divided by separator / electrolyte material, given that the separator type is arguably the most critical differentiator among each — and is typically where the most valuable IP sits for the full solid-state battery cell.

The primary separator types discussed will be:

Ceramics / Oxides

Sulfides

Polymers

Ceramics / Oxides

A ceramic is an inorganic, nonmetallic solid, generally based on an oxide, nitride, boride, or carbide compound, that is fired at a high temperature. Ceramics are more-resistant to dendrite formation than other materials (given they are not metals), do not degrade much over time, and are moderately electrically conductive.

On the other hand, the ceramic is the heaviest type of separator (which adversely affects energy density), and they easily react with moisture, generating a liquid film on the battery that needs to be cleaned.

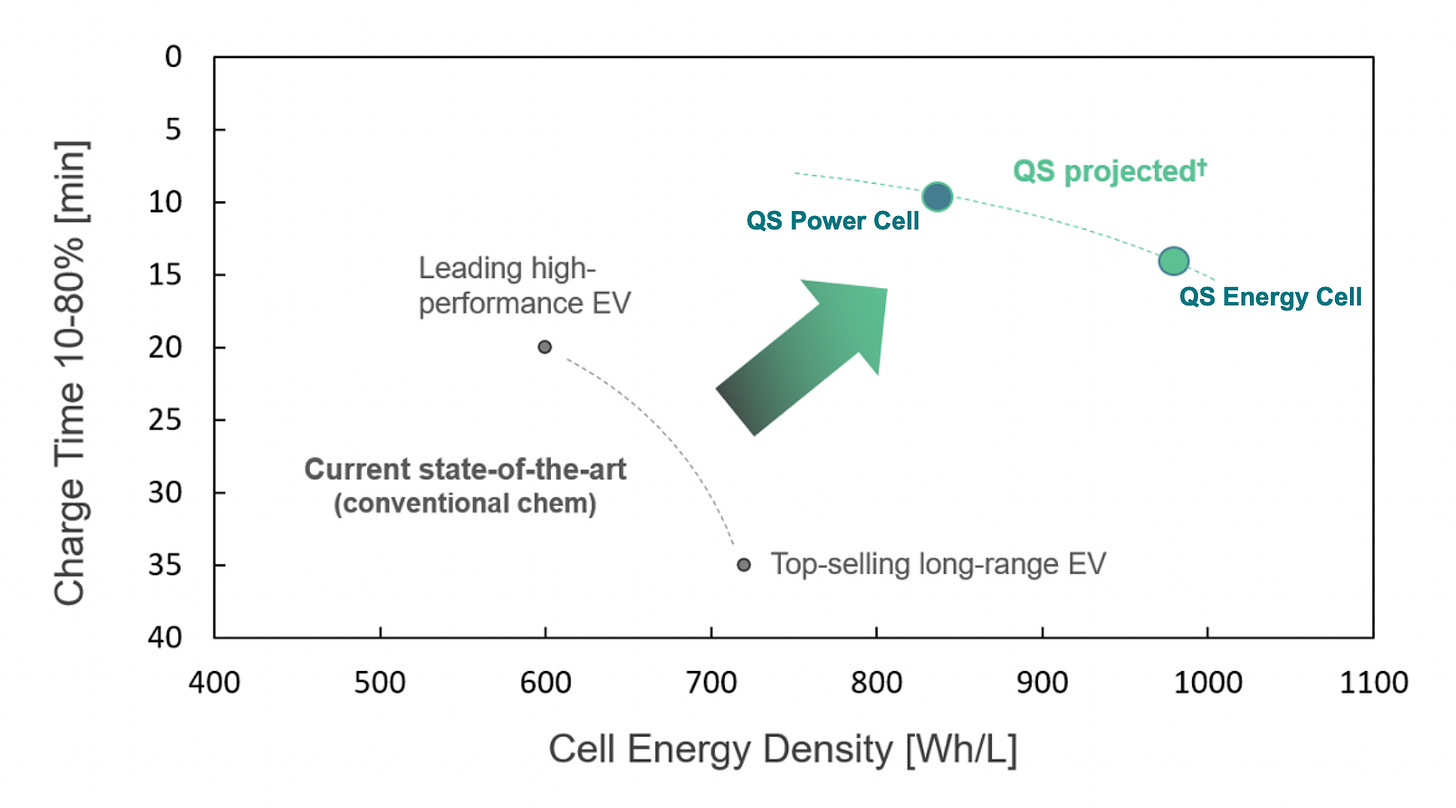

The most notable solid-state battery developer is QuantumScape (~$1.4B raised to date; venture backers include Khosla Ventures, Breakthrough Energy, Lightspeed, and Kleiner Perkins), which went public via SPAC in November 2020 (NYSE: QS) and now sits at a $5.5B market cap (as of 5/31/22).

QuantumScape utilizes a ceramic separator, and the company discusses the differentiation of the separator on its website:

“The QuantumScape separator material is a ceramic capable of meeting the key requirements of high conductivity, stability to lithium metal, resistance to dendrite formation, and low interfacial impedance. These are the key requirements to make a lithium-metal anode, which in turn enables high energy density, fast charge, and long life.”

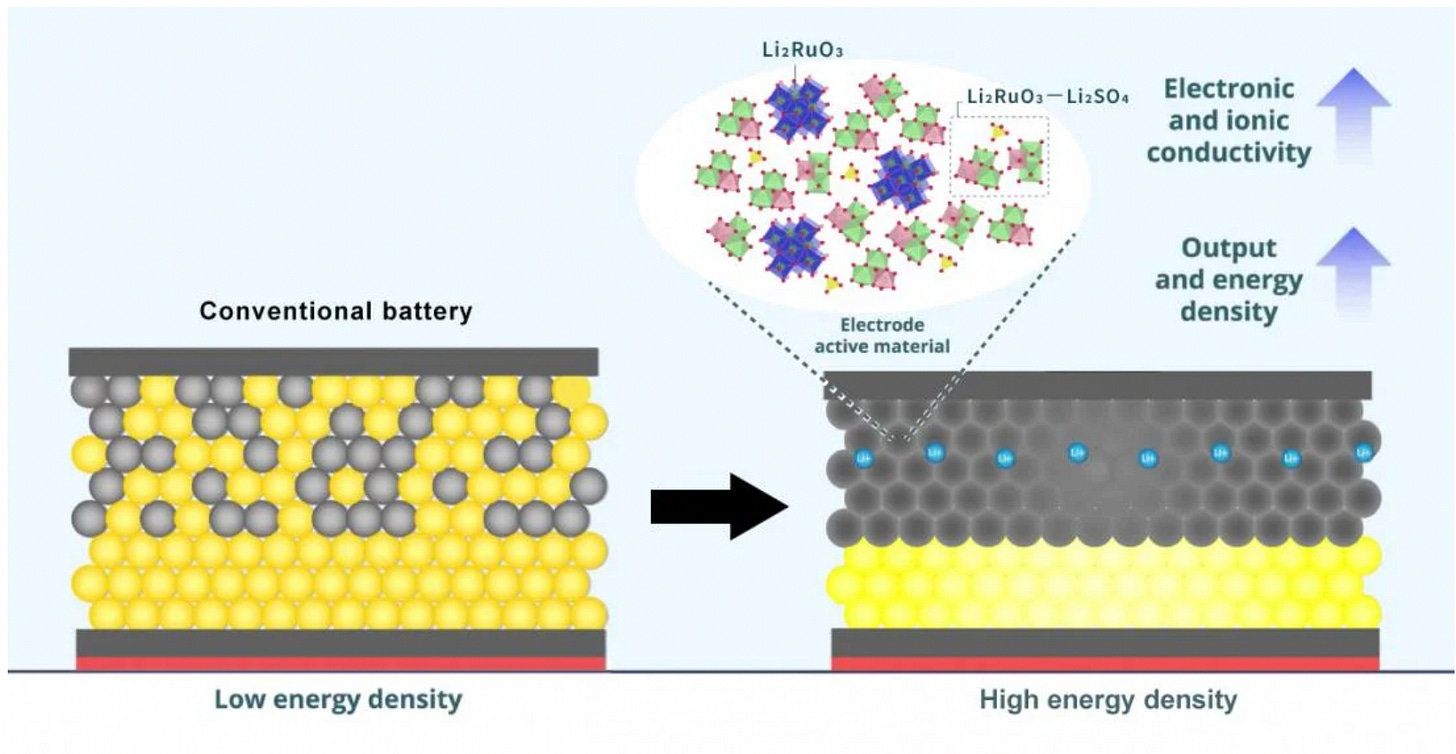

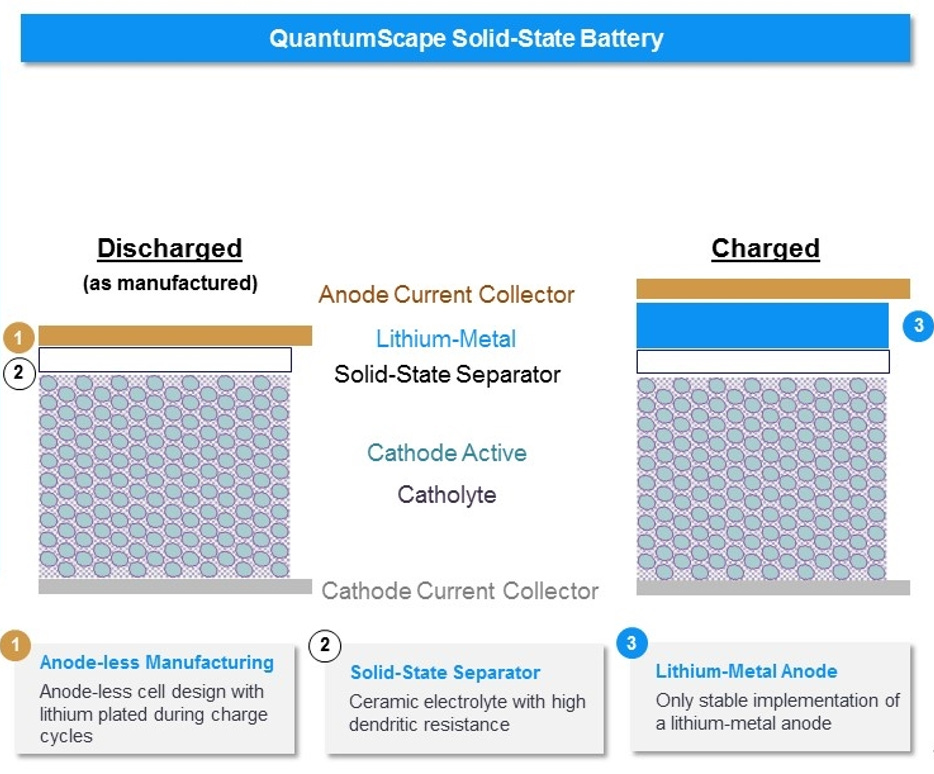

Another unique facet of QuantumScape’s battery is its “anode-less” design. As the cell charges for the first time, lithium-metal ions are actively deposited onto the current collector, which acts as the anode from then onward. This anode-free design alleviates the need for expensive lithium foils and also increases overall energy density given the smaller volume of the battery.

Despite the ceramic separator’s natural resistance to dendrites, the anode-less structure of QuantumScape’s battery actually creates an upper limit on energy density given how the anode expands into the volume of the cell. This expansion process can form lithium dendrites that penetrate through the solid electrolyte and short-circuit the battery.

Looking to future commercial production, QuantumScape’s partnership with Volkswagen, which is now also the largest shareholder in the company (~20% ownership), represents the solid-state battery industry’s largest commitment from an automotive manufacturer (~$300M of corporate funding commitment and $400M+ directly invested to date). VW and QuantumScape are targeting the establishment of a commercial production line for solid-state batteries by 2025.

The other major ceramics-focused player is ProLogium ($538M capital raised to date; most of its capital has been provided by Daimler / Mercedes-Benz as well as various investment groups in China), which utilizes an oxide-ceramic separator alongside a lithium anode. ProLogium defines its ASSB technology as “solving the innate interface problems of solid-state batteries, creating advantages in fast charging, longevity, and low-temperature performance, and together they become a unique lithium ceramic battery.” ProLogium is rumored to be exploring an IPO, which if successful, would make it the third pure-play solid-state battery company to be publicly traded.

Sulfides

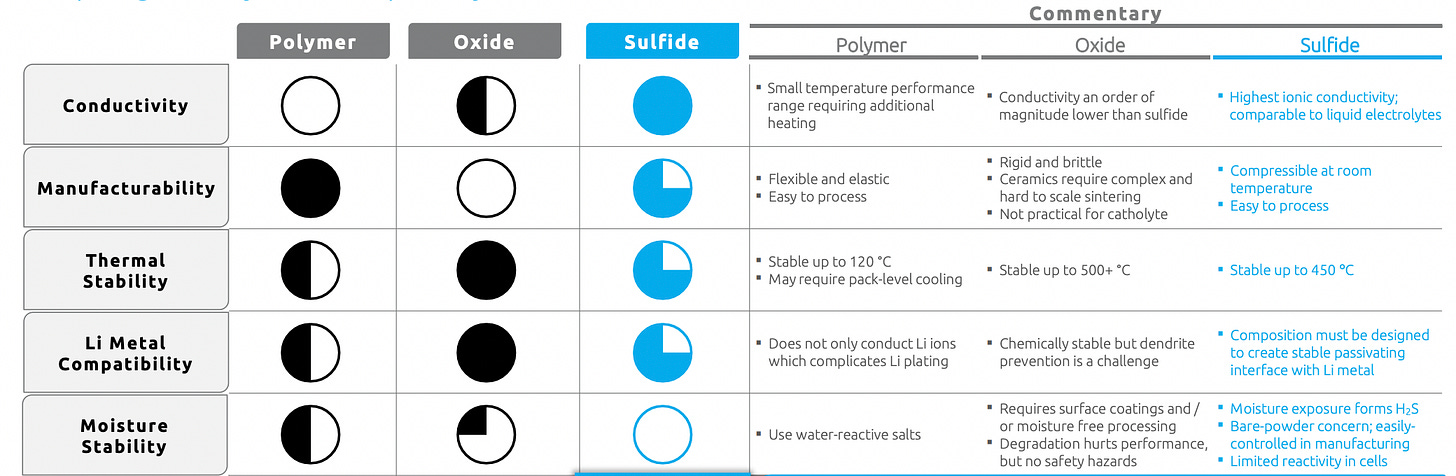

Sulfide-based separators clearly lead in electrical conductivity — a critical property driving ASSB performance — but high conductivity also makes it prone to adverse chemical reactivity. Sulfides have the highest potential for high-end performance and battery capacity and can be manufactured easily and at very low cost — but solving for the chemical reactivity issue (which leads to both dendrites and moisture build-up) and its moderately high mass density (2x that of the lightest polymers) is the primary challenge that researchers are working on.

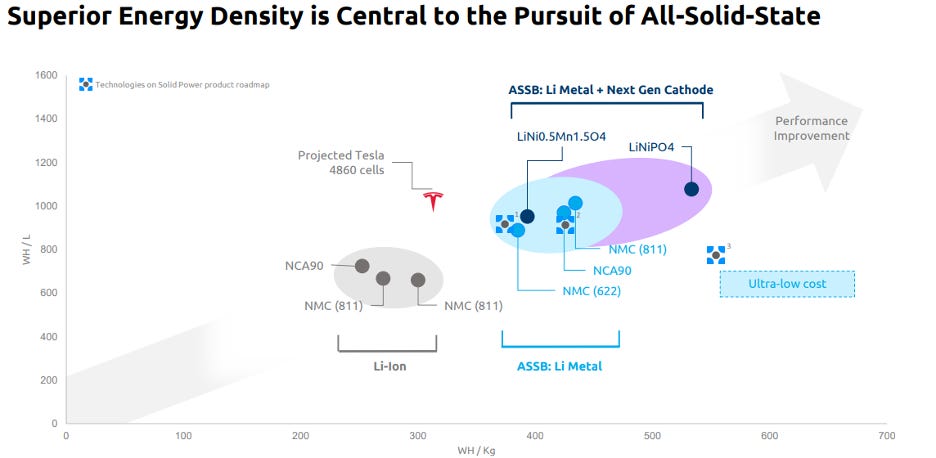

Colorado-based Solid Power is one of the leading sulfide-focused solid-state battery developers (~$360M raised to date; venture backers include Koch Strategic Platforms, Neuberger Berman, Innosphere Ventures, and Equinor Ventures). Solid Power went public via SPAC only 6 months ago in December 2021 (NAS: SDLP), and currently trades at a $1.6B market cap (as of 5/31/22). Its major automotive partners are Hyundai, Ford, and BMW – and there are joint development agreements in place with the latter two, who each invested $65M in the business and took board seats in May 2021. These partners are helping Solid Power expand its Colorado factory footprint as it looks to prepare a pilot production line later this year.

Solid Power’s lithium-sulfide separator is described by the company as “the best combination of conductivity and cell-level performance [in the industry],” as it has been specifically tuned for high conductivity and lithium metal stability.

Interestingly, past the separator, Solid Power is also at work developing a low-cost iron-sulfide-pyrite cathode formulation, eschewing the typical battery materials of nickel or cobalt, which are two of the costliest raw battery materials.

Solid Power CEO and Co-Founder Doug Campbell touched on this last year:

“[The industry] is going to be dominated by the cost of materials and the cost of materials is going to be dominated by the cost of that nickel- and cobalt-containing cathode material,” he said. “This particular chemistry… is extremely low cost, we’re talking 1/20th, 1/30th the cost of today’s [nickel manganese cobalt cathodes].”

Solid Power sums up its sulfide separator edge in the below chart from its SPAC merger investment presentation:

Solid Power’s differentiated materials are expected to result in densities ranging from 375 Wh/kg to 550 Wh/kg. I’d also note that these expectations are significantly higher than Tesla’s cutting-edge lithium-ion 4680 cells, which will sit somewhere below 350 Wh/kg.

As for the rest of the sulfide-separator ASSB competitive landscape – Toyota, Hyundai, Samsung, and LG all have their own all-solid-state battery research programs centered around sulfides. Toyota and Samsung are likely leading this corporate pack. Toyota, interestingly, is planning to release a battery in 2025 for use in a hybrid vehicle (i.e., a solid-state battery and internal combustion engine working together), given that it wants to introduce solid-state batteries to the market as soon as possible to get customer feedback. Samsung, on the other hand, is extremely far along in its solid-state battery development, but plans for its first ASSB iterations to be used in e-bikes and scooters as soon as 2023. Samsung, however, has deep EV battery experience given that it is a major supplier of Tesla’s new 4680 battery, and is working toward commercial production of ASSBs for EVs by 2028.

Polymer

Polymers, which have historically been rejected as a suitable ASSB separator due to the low electrical conductivity and low maximum operating temperature of nearly all candidate polymer solids, have recently made a comeback. New advancements in polymer materials discovery and synthesis techniques have enabled high-conductivity, lightweight polymers that make for effective, non-chemically reactive solid electrolytes.

The most well-funded solid-state battery developer taking a polymer separator approach is Massachusetts-based Factorial Energy (~$250M raised to date; investors include Eden Rock, Ithaka Partners, Helios Climate Ventures, and several OEMs described below), which is a newer entrant to the ASSB space, having just come out of stealth mode in April 2021. Factorial’s ASSB technology revolves around its solid electrolyte material dubbed FEST (Factorial Electrolyte System Technology) that involves a special polymer separator. Battery cells using FEST reportedly exhibit 350 Wh/kg energy density with potential to reach 400+ Wh/kg in the near-term, and Factorial claims that their batteries recently achieved an industry-leading, battery capacity of 40 Ah (Amp-hour, which is a similar measure to Wh shown throughout).

Interestingly, executive chairman Joe Taylor shared late last year:

"Our technology can be easily integrated into existing lithium-ion battery manufacturing infrastructure – which makes Factorial an immediately viable partner for every automaker pursuing EVs."

Factorial’s closest automotive manufacturer partner is Mercedes-Benz, with Kia, Hyundai, and Stellantis (parent of Fiat Chrysler) also involved – all four invested in the $200M Series D round in January ‘22. In conjunction with these partners, Factorial is about to begin construction on a pilot production facility at a location to be announced in the New England area, with the goal of achieving scaled production of FEST batteries in 2-3 years.

Another polymer-focused player is Ionic Materials (~$85M raised to date; investors include Hyundai, Kleiner Perkins, Samsung, and Franklin Templeton), whose polymers were originally developed for lithium-ion batteries but are now also being utilized for solid-state batteries. The company has stated that “scientists at the City University of New York have found that Ionic Material’s proprietary ionic conducting polymer is the most highly lithium conducting solid state polymer material ever measured (at room temperature),” which is an exciting development. This polymer is also compatible with a variety of anodes and cathodes, giving flexibility in terms of structure of the rest of the battery. Ionic Materials has not announced specific commercialization dates, but a joint venture with Hyundai seems likely given the level of collaboration between the two.

A newcomer to the scene based out of Florida, Piersica (~$1M raised to date), has developed its own proprietary lightweight polymer separator that maintains high conductivity. Piersica has also developed a unique 3D porous, nanofibrous anode structure that maximizes surface area (and thus reduces concentration of metal buildup that leads to dendrite formation). The company’s advances have led it to be awarded a coveted spot in the Chain Reactions Innovations (CRI) program at the Argonne National Laboratory, the most advanced energy technology laboratory in the United States; Piersica was one of five winners out of over 2,500 applications. This will be a company to watch going forward.

Other Methods

Although there are little published materials on its separator, Chinese battery powerhouse CATL (largest lithium-ion battery manufacturer for EVs in the world with 33% market share) is taking a lithium-metal anode approach for its solid-state batteries not too dissimilar to QuantumScape. CATL has been relatively quiet about its ASSB research & development, which has reportedly been ongoing for over 10 years, but they have publicly stated that they see a path to 350-400 Wh/kg energy densities with their lithium-metal approach. CATL is separating its timeline into “generations,” with the first generation of ASSBs, which would have roughly the same energy density as current lithium-ion batteries, expected to emerge by 2025, followed by second generation ASSBs significantly superior to lithium-ion by 2030.

Long-Term Future

Solid-state battery technology is expected to allow electric vehicles to jump the gap in energy density limitations seen in the lithium-ion paradigm to enable truly long-range and fast-charging electric vehicles.

Lithium-ion cells are only making marginal improvements, and 400 Wh/kg energy density is needed to enable long-range, high-performance EVs that will open the addressable market of customers much broader.

With all of the different types of ASSBs being developed right now — between the various iterations of ceramic, sulfide, and polymer based solid-state batteries — there’s a high likelihood that at least one architecture wins out (if not more).

Industry Predictions: Short-Term Pain for Long-Term Power Gains

With all of this in mind, here are my short-term (one-year) and long term (3+ year) predictions:

Short-Term Predictions (Next 1-2 Years)

Breakthroughs related to new polymer materials will put pressure on the solid-state battery leaders relying on sulfide- and ceramic-based separators. The major sulfide and ceramic players are continuing to face dendrite issues — the previously overlooked polymer players will more easily solve for this issue and make a comeback over the next few years. Polymer-based separators will also likely see more attention once ProLogium goes public and showcases its technology to the broader world.

Public companies in the space, QuantumScape and Solid Power, will face intense scrutiny over their SPAC projections and how they compare to ongoing performance. QuantumScape, one of 2021’s top SPAC darlings, and Solid Power, which went public via SPAC several months later to moderate fanfare, released ambitious technology roadmaps and financial projections ahead of the consummation of their SPAC mergers. Their stocks have plummeted ~90% and ~33%, respectively, from their peaks as the public markets have punished unprofitable technology businesses over the last 4 months. Nearly all of the privately held ASSB players will stay private for longer to avoid this issue, working unfettered with their heads down on R&D during the ongoing economic downturn.

Long-Term Predictions (2025 and Beyond)

The lithium-ion battery architecture will reach its theoretical performance ceiling by 2028. Many industry experts believe that lithium-ion energy density is approaching its theoretical ceiling, which is estimated to be somewhere between 300-350 Wh/kg. For reference, Tesla’s Model 3 lithium-ion batteries have a 260 Wh/kg density currently and is expected to increase at most to 300-320 Wh/kg in the medium-term. While lithium-ion advancement slows, solid-state batteries will continue to see jumps in energy density each year.

Commercialized solid-state batteries will begin to take significant EV battery market share from 2029 onward. The current global lithium-ion battery market is ~$46B in size and expected to grow at a 25%+ CAGR per most industry analyses, meaning it could total $200B+ by the year 2030. If solid-state batteries for EVs are commercialized for mass production by then, which is well within product roadmap dates of the major industry players, then ASSBs will begin to take 1-2% market share annually away from lithium-ion batteries in the 2030s.

Solid-state batteries will achieve cost parity with lithium-ion batteries on a price per kWh basis by 2037 and be installed in >10% of all new EVs. Back in 2010, the cost per 1 kWh for lithium-ion batteries was over $1,200 / kWh, and in the span of a decade, that cost has gone down nearly tenfold to ~$130 / kWh today. Discounting for its nascency, solid-state batteries will achieve at least a similar tenfold decrease over the next 15 years, down from >$800 / kWh currently. For example, Solid Power believes that their technology will bring down the cost of EV battery packs to as low as $85 / kWh by the end of the decade (vs. predictions of lithium-ion only able to reach ~$100 / kWh at their most-optimized), which is a good, yet ambitious benchmark.

Tying it All Together

EV customers today are generally forced to make a choice between (i) cells that offer higher energy density but low power (e.g., a long-range EV), or (ii) high power but lower energy density (e.g., a high-performance EV). High energy density also comes at the cost of slower charging — a currently unavoidable tradeoff.

New chemistries will be needed to enable high performance, fast-charging, and long-range EVs. Solid-state batteries can push the power-energy curve out further to a new frontier.

Tesla CEO Elon Musk tweeted last year:

“Battery cell production is the fundamental rate-limiter slowing down a sustainable energy future. Very important problem.”

In solving this problem, solid-state batteries embody a new category that will not only take a leap in energy density, but also increase the overall supply of battery cells alongside their next-generation lithium-ion relatives — this will pave the way for faster EV production.

With electric vehicles poised to dominate the projected $7+ trillion automotive manufacturing market in 2040, solid-state battery technology has a tremendous opportunity to accelerate EV adoption by enabling competitive performance with gasoline-powered cars (and hopefully in the very long-term, at comparable price points).

The continued development of solid-state batteries, most of which is taking place in the U.S., represents another area of American manufacturing dynamism that has seen a resurgence over the past 10 years. In the U.S.’s ongoing battle to maintain a long-term competitive edge (30+ year time horizon) in the electric vehicle industry, solid-state battery technology leadership will almost undoubtedly play an important role.

Please forward this email and ask friends to subscribe, especially those working in early-stage startups, larger technology companies, or venture capital!